Price action breakout strategies are powerful trade signals that often lead to strong moves in the market. Breakouts strategies can form in trending markets or as counter-trend signals, the defining characteristic of a price action breakout strategy is that the breakout leads to a strong directional move either up or down.

Let’s take a look at several examples of price action breakout strategies…

Trading price action pattern breakouts as continuation plays…

In the example chart below, we can see a clear uptrend was in place prior to the formation of a bullish fakey trading strategy. Note that once price broke out above the mother bar high of the fakey pattern, it set off another leg higher in the uptrend. Thus, this is an example of a fakey breakout strategy in a trending market, also called a trend continuation play…

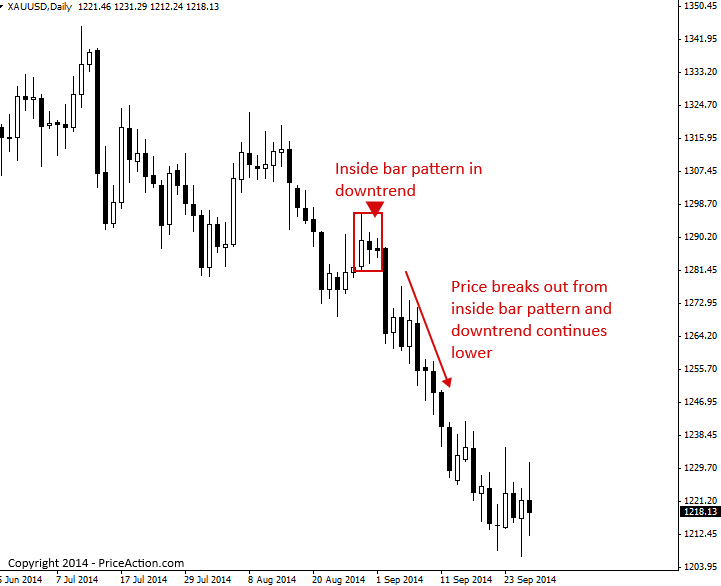

The next chart shows an example of an inside bar breakout strategy with a trending market. Inside bars are perhaps the most ‘classic’ price action breakout strategy because they show a breakout from the consolidation of the inside bar setup. On a lower time frame such as a 1 hour chart, a daily chart inside bar will look take the form of a consolidation range, sometimes a triangular range. So, when price breaks out from a daily chart inside bar it’s also breakout from a small trading range on the lower time frames.

The next chart example shows how to use a fakey with pin bar pattern as a breakout strategy. This example is showing the pattern traded in-line with strong bullish momentum, so in that regard it would also be considered a breakout / continuation play.

Note the strong surge higher just before the fakey pin bar pattern formed, then after that bullish fakey pattern formed, we could tell by the pin bar and the false break to the downside that a potential upside breakout was coming that could lead to another leg higher. We can see that once price broke above the pin bar’s high, it just rocked higher as the upside breakout took hold.

Sometimes in a strong trend, either up or down, you will see a pin bar, inside bar pattern or even a fakey form near the most recent highs or lows of a move. These patterns can sometimes lead to a trend continuation of price breaks out from them. It can be tricky trading a price action pattern after at the lower end of a recent down move or the upper end of a recent up move, because normally we’d like to see a rotation back to value (support or resistance) first. But, often, IF a trend is very strong, such as the downtrend we see in the chart below, a price action signal formed near the end of the move can lead price continuing to move in the direction of the trend, even if little retrace has occurred. We see a clear example of this in the pin bar sell signal which at the time, formed near the lows of the move in this market, and note that even though there was minimal retrace higher, when price broke out below the pin bar’s low, it set off another big let to the downside.

Trading price action pattern breakouts from key chart levels

You might be wondering how you can trade a ‘breakout’ as a ‘reversal play’. Will it’s simple really. If a price action pattern forms at a key chart level of support or resistance, and then price breaks out from that pattern, reversing away from the key level, then you have a ‘breakout – reversal play’.

In the chart example below, we see a pin bar inside bar combo pattern that formed at a key chart level of resistance. Note that once price broke down below the low of the pin bar (which was also the mother bar of the two inside bars), it set off a big down move that lasted for more than a month…

Here’s another example of trading a price action pattern breakout from a key chart level. In this example, we are looking at a bullish fakey buy signal that formed at a key level of support in the market. Note how once price broke up above the mother bar high of the inside bar (remember a fakey is an inside bar false breakout) it led to a strong directional move to the upside. When you see a fakey pattern like this at a key level of support or resistance, it’s time to take notice as a possible breakout move is coming…

Tips on Trading Price Action Breakout Strategies

- Price action breakout strategies often set off powerful moves. Watch for them in trending markets as continuation plays, from key chart levels or as trading range breakouts.

- Breakout strategies are usually used with stop entry orders. Meaning, you place a buy or sell stop order near the price action breakout strategy high or low and then when price breaks out, it hits your entry order and brings you into the market. The fact that you are being brought into the market on momentum is good, it’s a little extra piece of ‘confluence’ that the trade is at least getting started off in your favor.

I hope you’ve enjoyed this price action breakout strategies tutorial. For more information on trading price action breakout signals and other price action patterns, click here.

AboutNial Fuller

Nial Fuller is a Professional Trader & Author who is considered ‘The Authority’ on Price Action Trading. He has a monthly readership of 250,000+ traders and has taught over 25,000+ students since 2008. Checkout Nial’s Price Action Trading Course here.